WESTERN PRODUCER — Less farmland has been bought and sold in Canada this year.

Prices haven’t dropped, but the lack of transactions is a signal that demand is softer, says the chief economist at Farm Credit Canada.

FCC will release its official estimates of farmland values for the first six months of 2024 in late September or early October.

However, it’s apparent that the appetite for farmland has weakened.

“In terms of sentiment, we have fewer (farmland) transactions. I think that’s undeniable. The first six months of the year, we recorded fewer transactions,” said J.P. Gervais.

“There is more caution and more negative sentiment because the transactions are fewer,” he said last week.

On Sept. 3, Purdue University published its Ag Economy Barometer report for August.

Farmer surveys indicate that American producers are worried about profitability in 2024 and in future years.

“In a sharp turnaround from July, farmer sentiment nose-dived in August,” says the Purdue-CME Group report.

“Weakening farm income prospects weighed on farmer sentiment as the outlook for a bountiful fall harvest were more than offset by declining crop prices…. The weakness in farmer sentiment could indicate that farmers expect this year’s farm income downturn to last for an extended period.”

Considering the prospect of softer grain prices, more American farmers believe that land values could also decline.

The percentage of U.S. producers who think farmland could drop in the next year increased from 13 per cent in July to 24 per cent in August, says the Purdue Barometer.

FCC doesn’t conduct a survey to track farmer sentiment in Canada, but informal conversations with FCC reps do tell a story.

Canadian farmers are worried about profitability.

“When we ask our (FCC) customers what is top of mind … commodity price is number one, input costs and interest rates, in (that) order,” Gervais said.

Such worries could push farmland prices downward because farm income has the largest influence on land valuations.

However, the key difference between Canada and the United States is that land values are more stable north of the border, Gervais said.

“Especially the Midwest, the swings and the volatility in the farmland market has always been greater than in the Prairies.”

Gervais said that stability will show up in the data when FCC releases its detailed estimates of farmland values.

“When we look at the numbers for the first six months (of 2024), we’re still going to see that steadiness, the steady increases still showing up despite fewer transactions.”

While profitability and farmer sentiment could weaken in the coming months and weigh down cropland values in Canada, Gervais said a drop in prices seems unlikely.

“Is it probable? I would say ‘no.’ I think the farmland market is on a lot more on solid ground than it is in the U.S … (because of) the makeup of ownership and the history.”

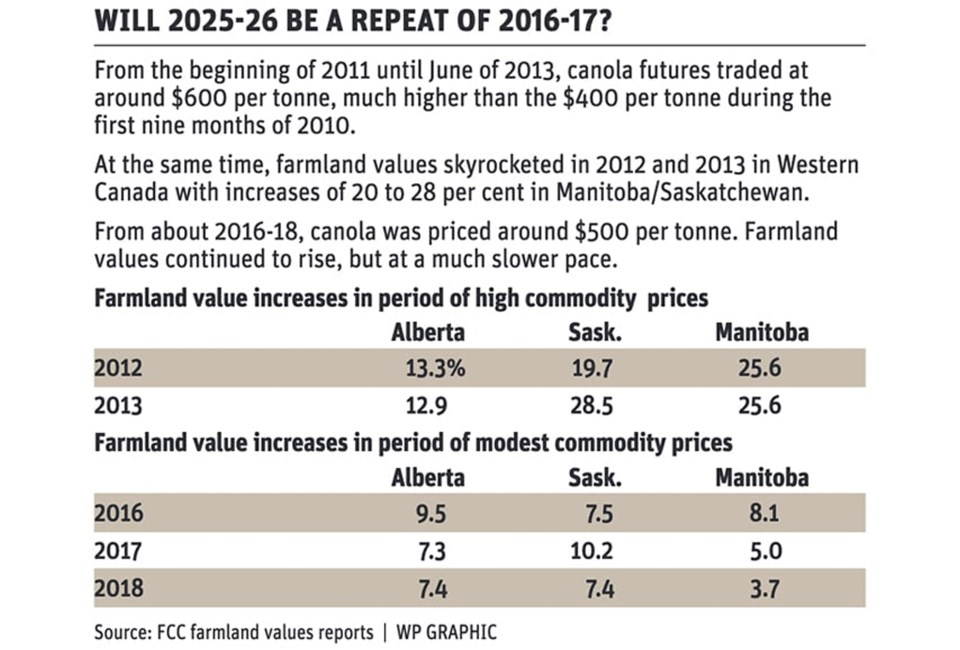

Still, a rise of 12.8 per cent in farmland values, like the increase seen across Canada in 2022, seems improbable in the near term.

“I think we’re likely to see the rate of increases in farmland values come down,” Gervais said.

Related

Canola crush productivity doubles in 20 years

Biologicals business receives funding boost

Pre-harvest prep needs herbicide management

Corporate fertilizer plan pushes sustainability

FCC, EMILI renew partnership to improve farm productivity

Farming north of 60 requires self-sufficiency

About the Author

More stories by Robert Arneson

.JPG;w=120;h=80;mode=crop)