YORKTON - There was discussion.

The dual operating and capital budget were split into two separate motions.

But, in the end, the documents first presented in open Council Jan. 31, was approved at this Monday’s regular meeting.

The total budget increase will be 4.86 per cent.

Overall, the impact to the average residential homeowner would be roughly $8 a month.

Budget preparations were begun by the individual departments in September and October of last year. These were compiled, analyzed and adjusted through our cooperative process during October and November, noted a report circulated to Council Monday.

During these meetings, departmental budgets were reviewed, discussed, and service levels were considered in conjunction with budget.

On the operations side the budget was prepared as a status quo document, meaning the budget is estimated to provide the same level of services to the residents of Yorkton as the year prior.

However, initial numbers were not good.

Our initial budget sat at over a 12 per cent increase in taxes required, with one per cent included in that for Capital, and the remaining towards our operating budget, said City Manager Lonnie Kaal in January.

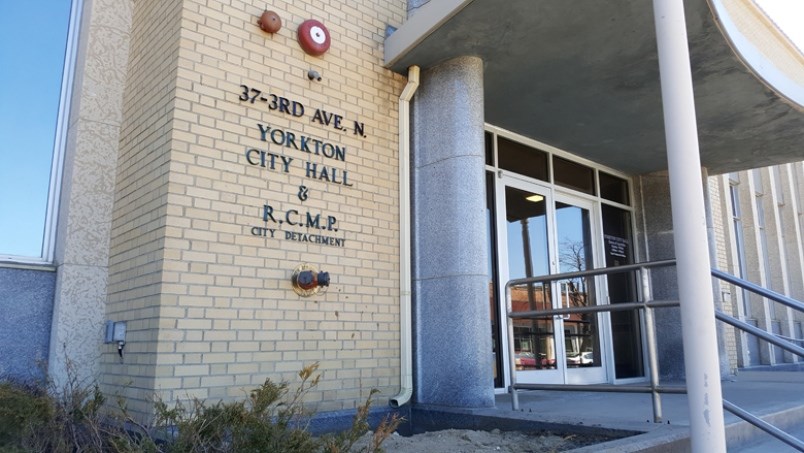

The vast majority of the increase was related to RCMP costs, about eight per cent of the initial budget numbers.

The RCMP increase “is due to a new collective agreement signed between the Federal Government and the RCMP. This is not a process that anyone from this city, or any city, was involved in. It also did not specifically involve our local RCMP – this was a Canada-wide process that our local RCMP did not have much, if any, input in,” explained Kaal.

“It involves significant increases in RCMP salary on an ongoing basis, as well as a very significant amount of retroactive pay which will be charged to the City in its upcoming contract year.”

In the end the budget numbers were wrangled down to what was presented in January and again Monday as a 4.86 per cent increase, 2.36 per cent relating to RCMP costs, 0.5 per cent to a decrease in Municipal Revenue Sharing from the province, and one per cent each going to general operations and capital.

It was noted the City plans to add one per cent per year to capital as it tries to address the infrastructure deficit.

The one per cent to operating comes in a year inflation is around 4.5 per cent, noted Mayor Mitch Hippsley Monday.

As for the RCMP costs the largest portion of this is retro pay, for which the City had been saving towards in the RCMP budget for a number of years. However, what was saved has, however, fallen short, with approximately $785,000 in reserves for policing to go towards the $1.4 million of retro pay. It was explained Monday the reserves for the RCMP accumulated over the years when staffing was not at full numbers. The salaries saved went to reserves, said Stradeski.

The increase is one the City had little input into, noted Councillor Chris Wyatt.

“We weren’t part of the negotiations,” he said.

The remaining shortfall is being taken from other reserves, primarily one established to cover costs when the City annexes land, he said, adding at present City-owned land inventory appears sufficient that an annexation will not occur in the next few years.

Coun. Randy Goulden did comment that the Federation of Canadian Municipalities and the Saskatchewan Urban Municipalities Association are lobbying for senior levels of government to assume some, if not all, of the back pay costs as they are onerous to municipalities.

As for the provincial funding decline, annually, the City receives funding from the province by the Municipal Revenue Sharing grant. This comes in the form of a share of PST revenue. The Provincial Government takes a portion of all PST revenue, and allocates it to municipalities. The loss to Yorkton is $137,000.

Revenues especially on the recreation facilities side of things were hit by COVID.

To offset this, the City will be using some of its COVID Safe Restart grant funding it received towards the end of 2020 to cover the lost revenue, as this was the intent of the grant. The City received $975,000 in 2020, of which $350,000 was utilized in the 2021 budget to offset expected decreased revenues. The remaining $625,000 has been in reserve, and we are recommending we utilize $265,000 to offset the temporary revenue losses projected for 2022 such that they are not a tax increase burden for the citizens of Yorkton, she explained.

The operating budget was unanimously passed Monday.

In terms of capital dollars, the one per cent allocation is roughly an addition of $255,000, said Kaal.

This will bring the annual capital total to $4,645,000 for 2022, and as this is a two-year capital budget there is a one per cent increase for 2023 towards capital (minimum) as well.

For the 2022 capital items, the majority of these were approved last year with our 2021 / 2022 capital budget. This included the initial funding for the York Road project, an estimated $17 million project which the City will fund in conjunction with Provincial funding from 2022 to 2027, with construction starting in 2023 for the roadway, with possibly some of the drainage and ditch work in 2022.

Additional projects to 2022 include upgrades to the Gallagher Centre ice plant, which will be funded through the recreation levy that’s already included in everyone’s tax bills, as well as well as work towards a Recreation Master Study.”

Stradeski noted that the work on the Kinsmen Arena, as well as the Gallagher Centre ice plant, and the already approved Deer Park Golf Course Clubhouse do not directly impact the capital budget as they are funded by the recreational levy already being paid on properties – originally to fund work on the Gallagher Centre.

The capital budget would pass, but only barely as Councillors Darcy Zaharia, Quinn Haider, and Mayor Hippsley sat opposed.