Some will want to hope it was merely an April Fool’s joke, but the federal carbon tax which came into effect in Saskatchewan April 1, is most certainly real.

If one were to buy into the vitriol of social media it is the worst thing to happen to this country – well apparently ever.

Of course we tend to forget income tax was initiated in its earliest form way back in 1917 – introduced as the Income War Tax Act of 1917. It was generally seen at the time as a temporary measure to fund Canada’s efforts in the First World War, the definition of temporary apparently having a decidedly different meaning back then than it does today.

If there is one thing governments of all stripes are good at it is creating taxes. It was a Conservative government led by then Prime Minister Robert Borden that gave us income tax, and Goods and Services Tax (GST) was introduced in Canada on January 1, 1991, by then-Prime Minister Brian Mulroney and his finance minister Michael Wilson.

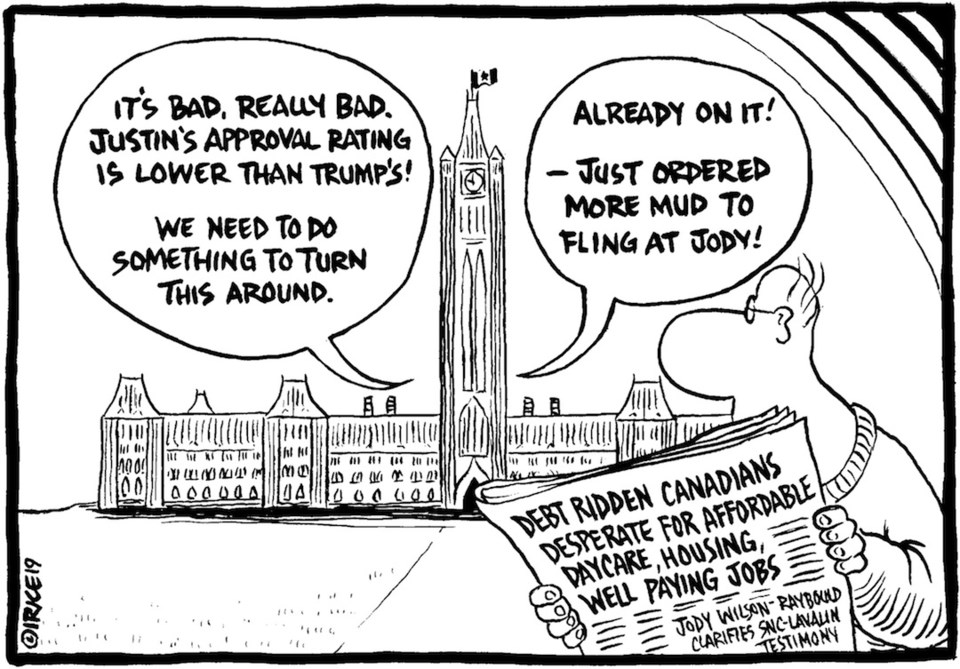

Now the Justin Trudeau led Liberals have brought us the carbon tax.

Proponents will suggest the tax has been brought in for the noblest of reasons, as a way to ‘encourage’ businesses to do a better job of controlling greenhouse gas emissions in order to help protect the environment from climate change moving forward. The idea is that business will not go down that road without a push, which the tax is supposed to provide.

The opponents of the carbon tax, and that includes our provincial government who have railed loud and long about the tax, see it as ill-timed, likely to be ineffective, bad for business and simply a tax grab. Of course the provincial government’s blustering might also be a good way to deflect attention from their own short comings in running our province – the heavy-handed elimination of the grants-in-lieu money to municipalities an example – but that is a whole different discussion.

The opposition is one of those usual mixtures of rhetoric and true concern.

Certainly, the overall economy is in a slowdown, in part because everyone is telling us it’s happening, and partly because of international realities in trade. That things are sluggish, the carbon tax will be a further drag. In that sense the carbon tax may be ill-timed and bad for business, at least until the system stabilizes. The GST was not popular in many quarters, but the economy adapted.

Of course ask anyone when is a good time for a new tax and the answer will be never.

As for a tax grab, that is of course the key question – what will the federal government do with the money? Can they use it in an effective way to elicit meaningful change in greenhouse gas emissions? Failure on that front will most certainly doom the carbon tax to be a blight on our country. Done correctly, perhaps our grandchildren will read a history book and say thanks.